How Retirement Solutions, Inc. Allocates Your Savings with NextPhase™

A clear investing approach for creating lasting, inflation-adjusted retirement income

Ask Yourself These Questions:

How much can I safely spend?

How much investment risk can I handle?

Are my retirement savings in the right place?

Do I have enough retirement savings to last my lifetime?

Meet NextPhase™

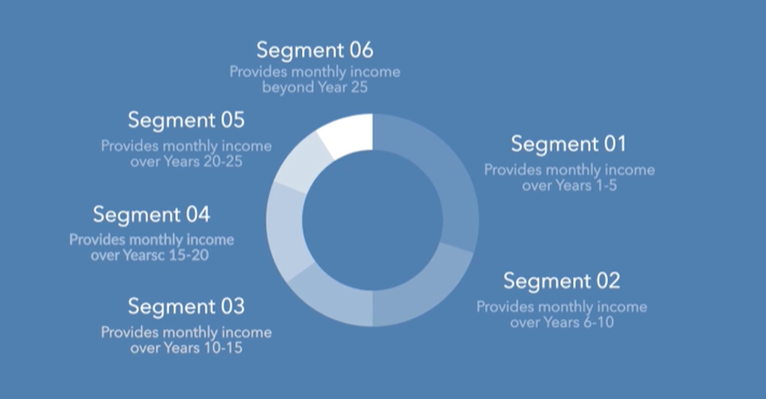

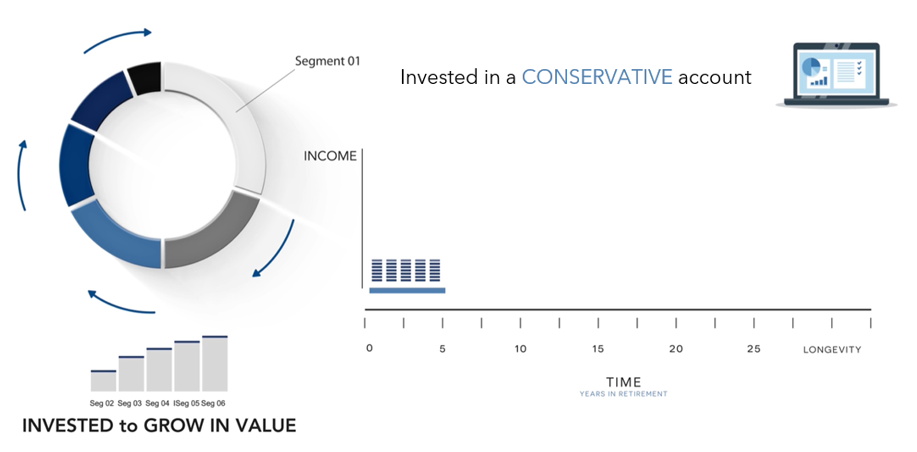

The Strategy

Segment 1

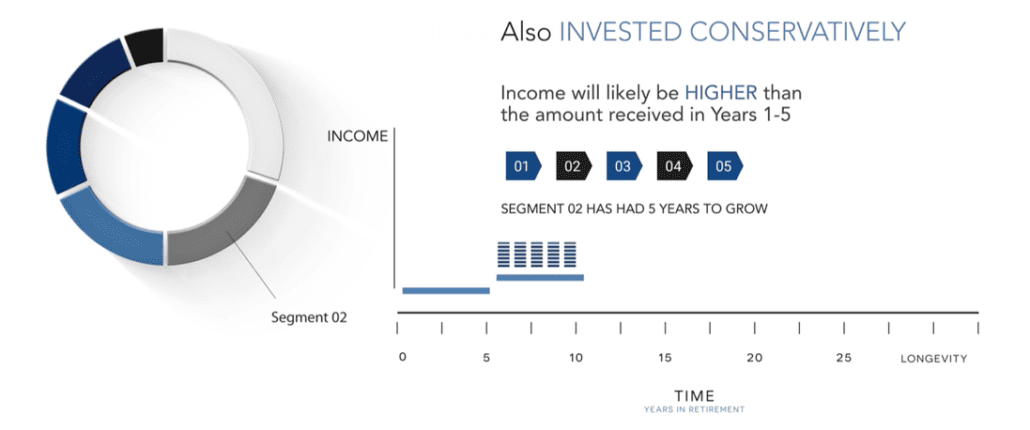

Segment 2

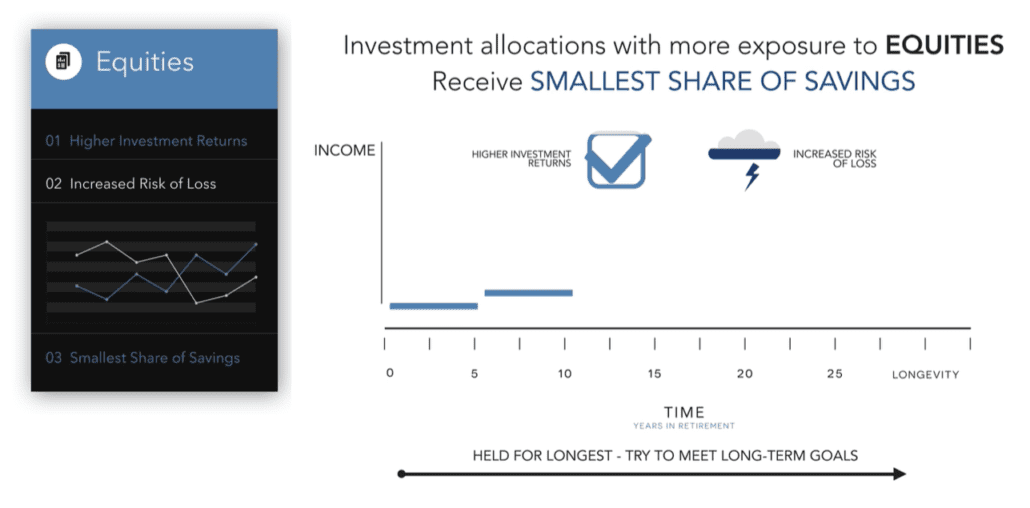

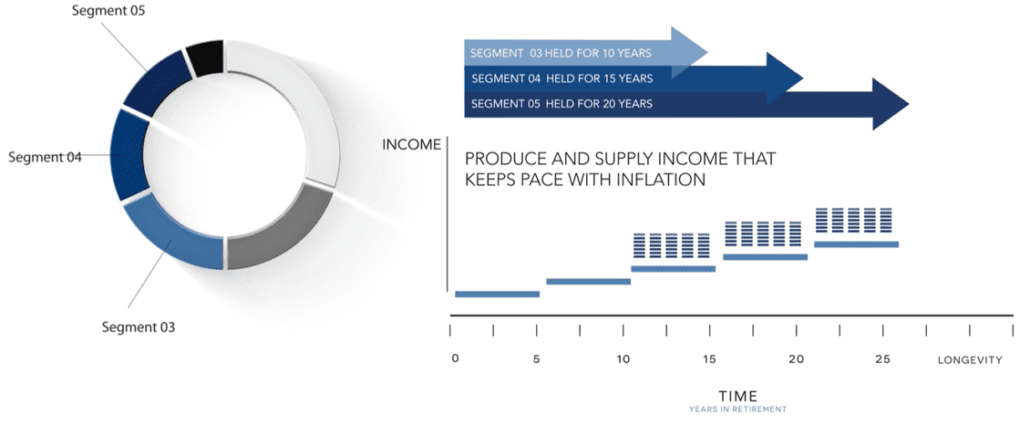

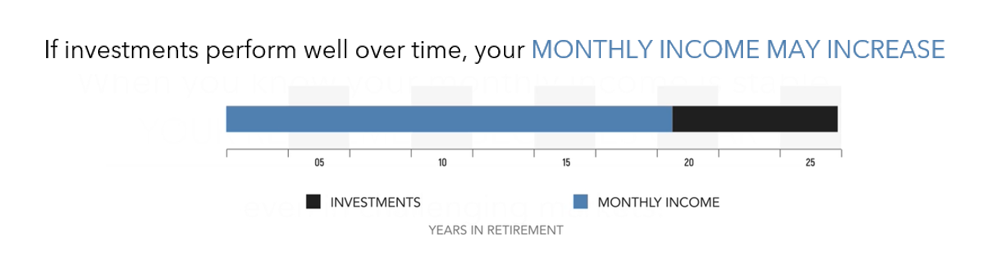

Segments 3, 4, 5

When you know your monthly income is predictable, your retirement becomes clear, even in challenging markets!

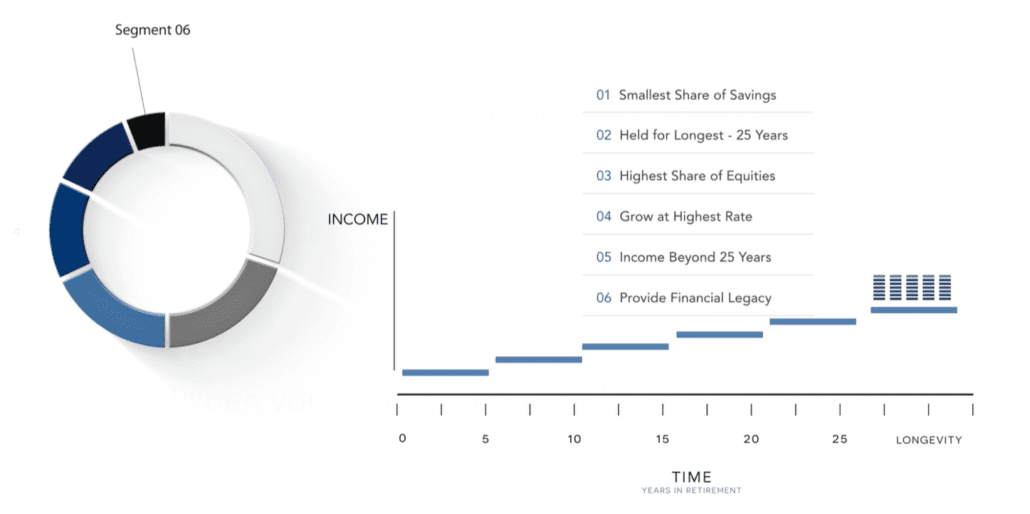

Segment 6

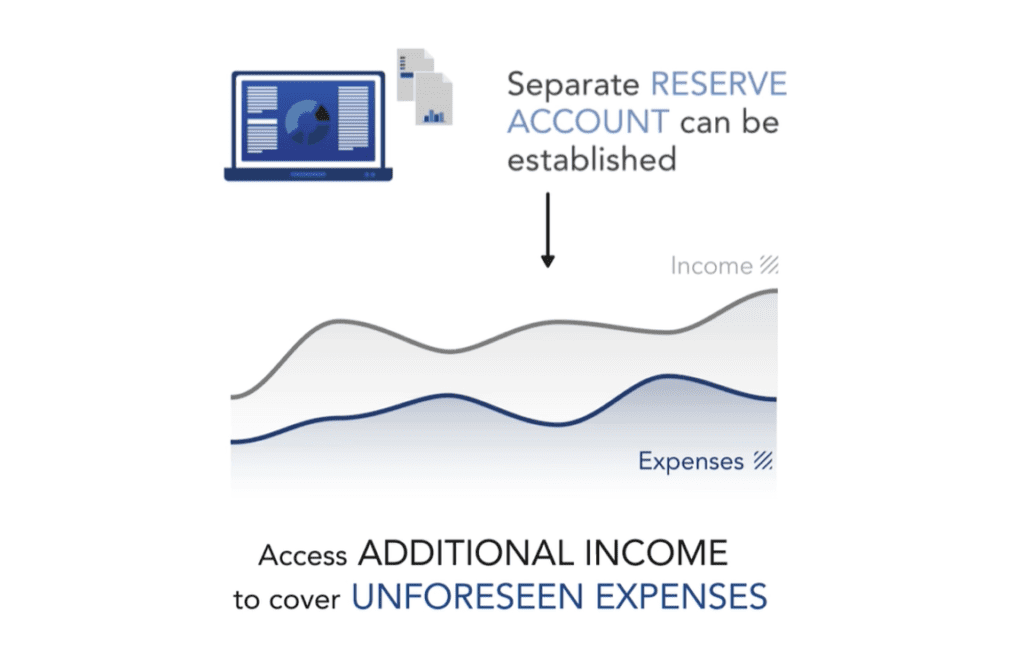

What If I Have An Emergency Need?

Will I Have Enough Money to Last My Lifetime?

If the equities in longer-term segments don’t perform well, the monthly income from your longevity strategy acts as a backup to help you meet your monthly expenses. This is an example of transferring a measure of risk away from you, and to an insurance company.

Want to see it work for you?

Don’t enter retirement without a clear plan for generating what no retiree can go without – income that lasts!

Investing involves risk, and you may incur a profit or a loss. There is no guarantee that NextPhase will perform as planned. If the strategy underperforms, the income levels and assets could be significantly reduced.

When utilizing annuities for guaranteed income, these guarantees are based on the claims paying ability of the issuing company.

Timing Risk is a trademark of Wealth2k, Inc. What’s My Income? is a registered trademark of Wealth2k, Inc.