Tax Smart Investments

Taxes are a top detractor from overall portfolio performance. Your financial advisor can help you implement strategies to make your investments more efficient.

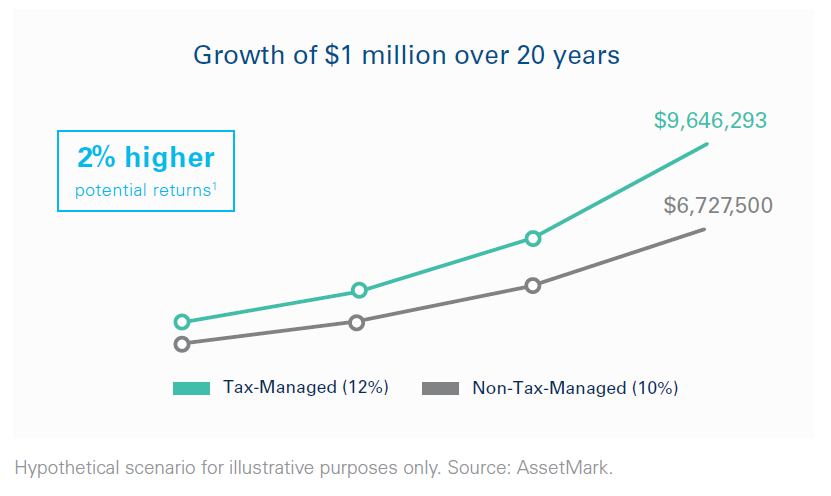

The Case for Tax Management

Scenario 1: Tax-Managed Portfolio

As part of an on-going tax management strategy, your financial advisor will consider opportunities to manage, defer, and reduce taxes to potentially improve your returns.

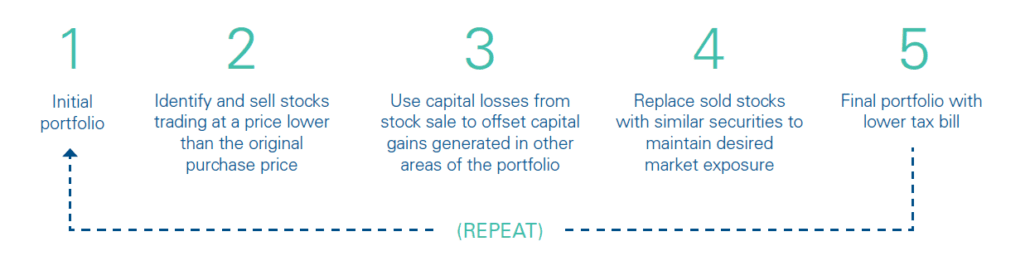

Scenario 2: Tax-Loss Harvesting – How It Works

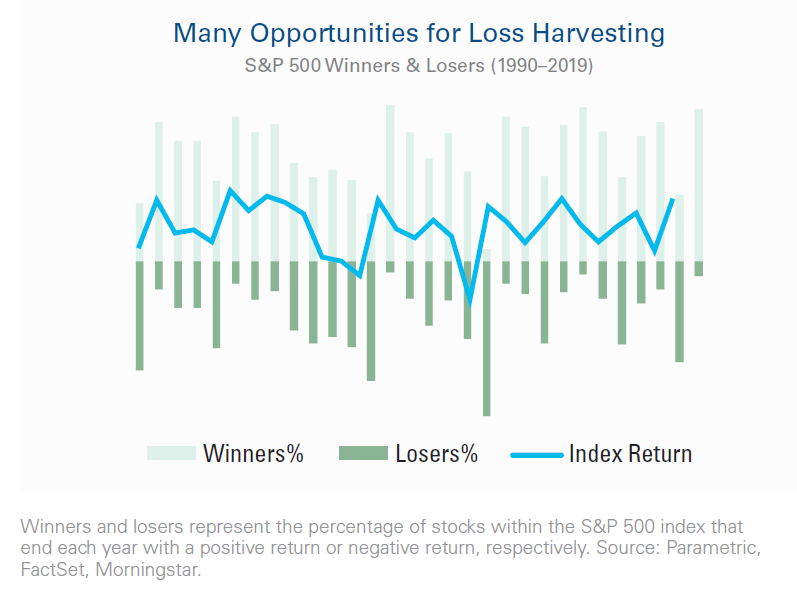

Tax-loss harvesting is a strategy of using investment losses to offset taxable gains in other areas of the portfolio.

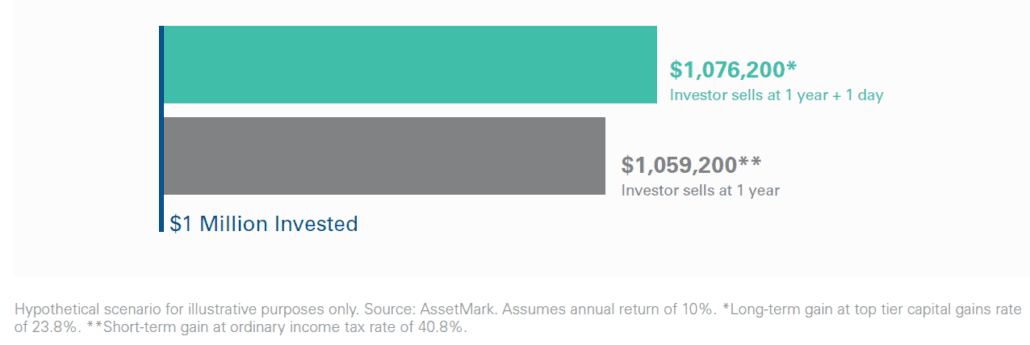

Scenario 3: Short-Term vs. Long-Term Gains

Over $170,000 difference in after-tax profit by waiting 1 day to avoid short-term capital gains tax

Investors Will Face Losses – Make the Most of Them

Talk to your financial advisor about putting these strategies to work for your portfolio

Source:

1 Rey Santodomingo, Andrew Subkoviak, Tax-Managed SMAs: Better Than ETFs?, Parametric Whitepaper, September 2020

Important Information

Investing involves risk, including the possible loss of principal. Past performance does not guarantee future results. Asset allocation cannot eliminate the risk of fluctuating prices and uncertain returns. There is no guarantee that a diversified portfolio will outperform a non-diversified portfolio. No investment strategy, such as asset allocation, can guarantee a profit or protect against loss. Actual client results will vary based on investment selection, timing, market conditions, and tax situation. It is not possible to invest directly in an index.

Investments in equities, bonds, options, and other securities, whether held individually or through mutual funds and exchange traded funds, can decline significantly in response to adverse market conditions, company-specific events, changes in interest and exchange rates, and domestic, international, economic, and political developments.

Please consult with a tax professioanl regarding your situation. Tax-qualified accounts, such as IRAs, do not benefit from tax-loss harvesting strategies.

AssetMark, Inc. is an investment advisor registered with the U.S. Securities and Exchange Commission. ©2021-2022 AssetMark, Inc. All rights reserved.

30003 | C21-17621 | 02/2022